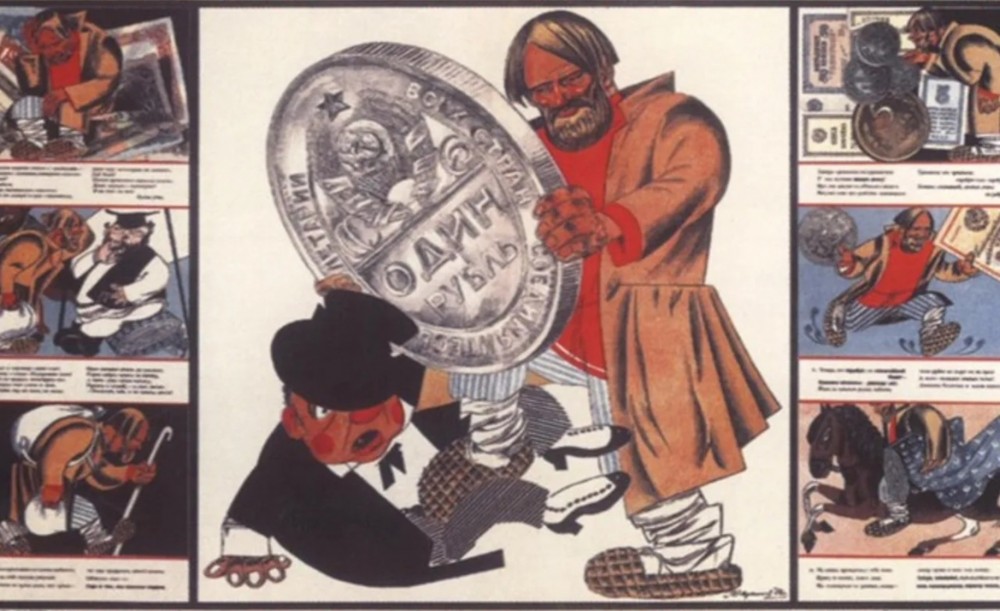

The article deals with the characterization of a taxation system and the identification of the share of taxes in an expenditure part of budgets of Ukrainian individual peasant farms in the context of tax policy of Soviet power in the age of NEP. The influence of taxes on the state of economy, everyday life of the Ukrainian peasantry has been analyzed. It has been proved that except expenditures on food and non-food items taxes were heavy burdens for peasant budgets because farms actually transferred the part of monetary income to the state budget, thus cutting their own already limited budget. By the mid-1920s agricultural tax revenues accounted for more than half of all budget revenues of the USSR state budget, which explains the state’s efforts to maintain high rates of this taxation type and its strict‚ timely implementation by peasant farms. It has been found out that tax pressure on the peasantry increased markedly in the second half of the 1920s. In particular in order to increase agricultural exports in December 1927 a decisive tax attack was announced, especially on wealthy peasants. Powerful peasant farms had to sell up to 35% of the harvest to the state at fixed (low) prices and pay 45% of the total tax imposed on to the village. The tax press which was carried out in violation of tax legislation had a negative impact on daily lives of all segments of pre-collective farm peasantry and led to detrimental consequences for agricultural production. Powerful farms were forced to curtail their production activities, many of them went bankrupt. An expenditure part of the budget of peasant farms except expenditures on food, non-food items and tax payment included the other expenditures on the maintenance of schools, places of worship, repayment of agricultural loans, the payment of taxes on non-agricultural earnings. An unbearable tax policy of the government for the majority of peasant farms caused dissatisfaction and the wave of peasant demonstrations‚ sharply negative public assessment of the NEP. Only during 1928 in Ukraine there were 150 demonstrations of peasants disagreed with agrarian, including tax policies of the Soviet state. Excessive grain procurements, loans, self-taxation, the only agricultural tax that increasingly resembled looting brought peasant farms to a catastrophically threatening state in the late 1920s.

Source: Terpan І. (2022). The Payment of Taxes in an Expenditure Part of Peasant Budgets in the Age of NEP (1921-1929). Antiquities of Lukomorie. 1: 56-64

Source web-site: http://www.lukomor.mosk.mksat.net/index.php/lukomor/article/view/138/131

Number of views: 1949