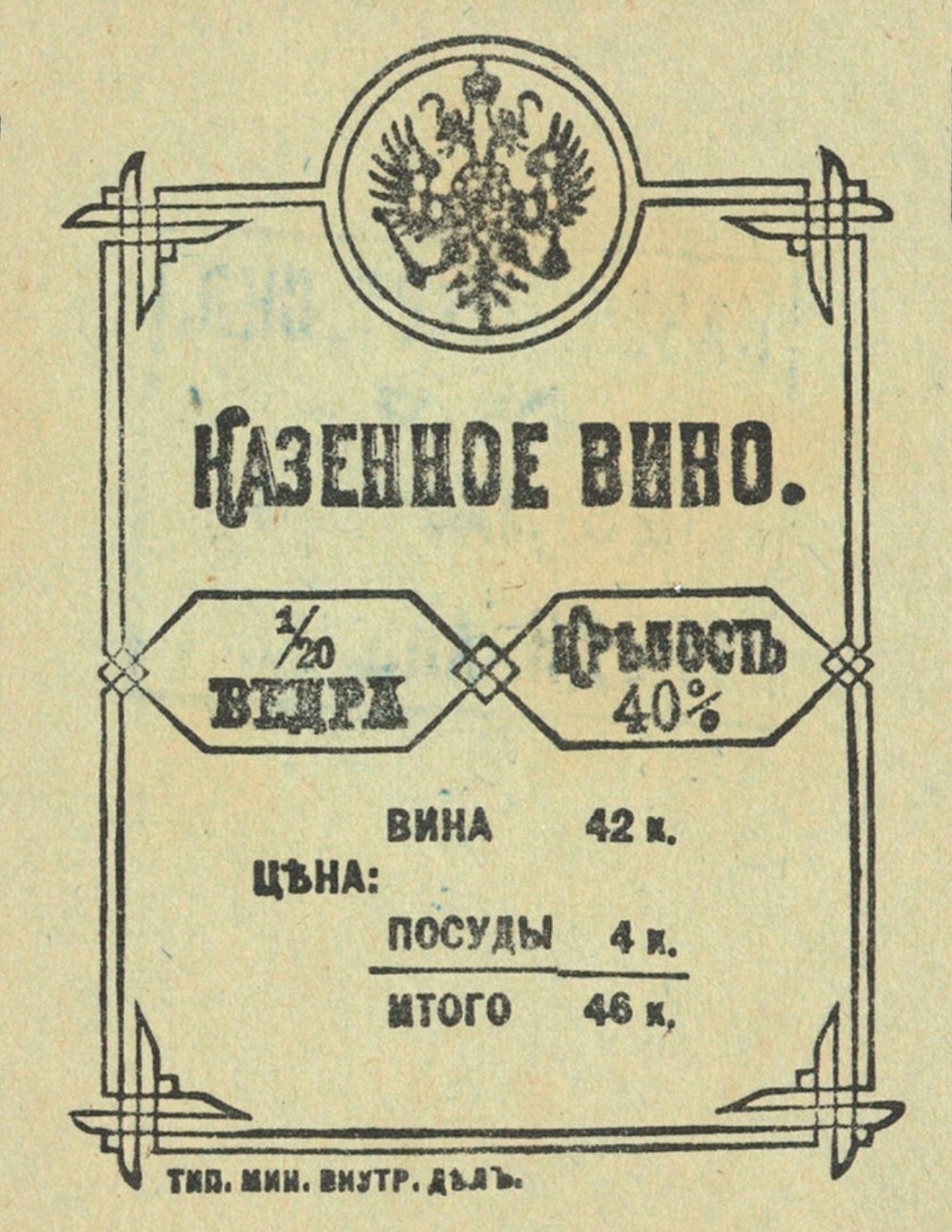

The article highlights the practical activities of excise departments, which were specially established for the conduct of the wine reform of 1863. This transformation was carried out in relation to the drinking collection, which was the most significant part of the state revenues of Russia. The steady receipt of the collection from drinking was guaranteed by the tireless, everyday activity of excise officials. Their functional responsibilities were clearly defined and included inspection of factory equipment, patenting of establishments that produced and sold alcohol, proper audits, accounting control and accounting, technical support of excise duty. Alcohol turnover was supervised day and night. The first level of supervision was provided by overseers assigned to each distillery, the second — by assistant district supervisors at their site; the third — by excise supervisors in their district; the fourth level of supervision was carried out by the excise manager, his assistants, auditors, technicians within the subordinated territory; the fifth — the Minister of Finance himself, the director of the Department of Non-payment Fees and the auditors of the specified department. Audits of distilleries were carried out for compliance of production with selected standards of distilling and included monitoring the full cycle from jam to distilling alcohol or for a separate distillery operation, readings of control shells were taken, factory reports were checked. During the audit of places of trade, measurements of dishes, the strength of wine were carried out, permits for trade were checked. The revisions were planned and sudden, brief and complete, and there were no restrictions on their number. The provincial and district excise administrations coped with their mission, the drinking income grew during the excise period. The epithet “excise” has become synonymous with the word “quality”.

Source: Goryushkina N.Ye. (2024). The Practice of Excise Supervision in Russia after the Wine Reform of 1863. Bylye Gody. 19(1): 189-198

Source web-site: https://bg.cherkasgu.press/journals_n/1709217126.pdf

Number of views: 1207